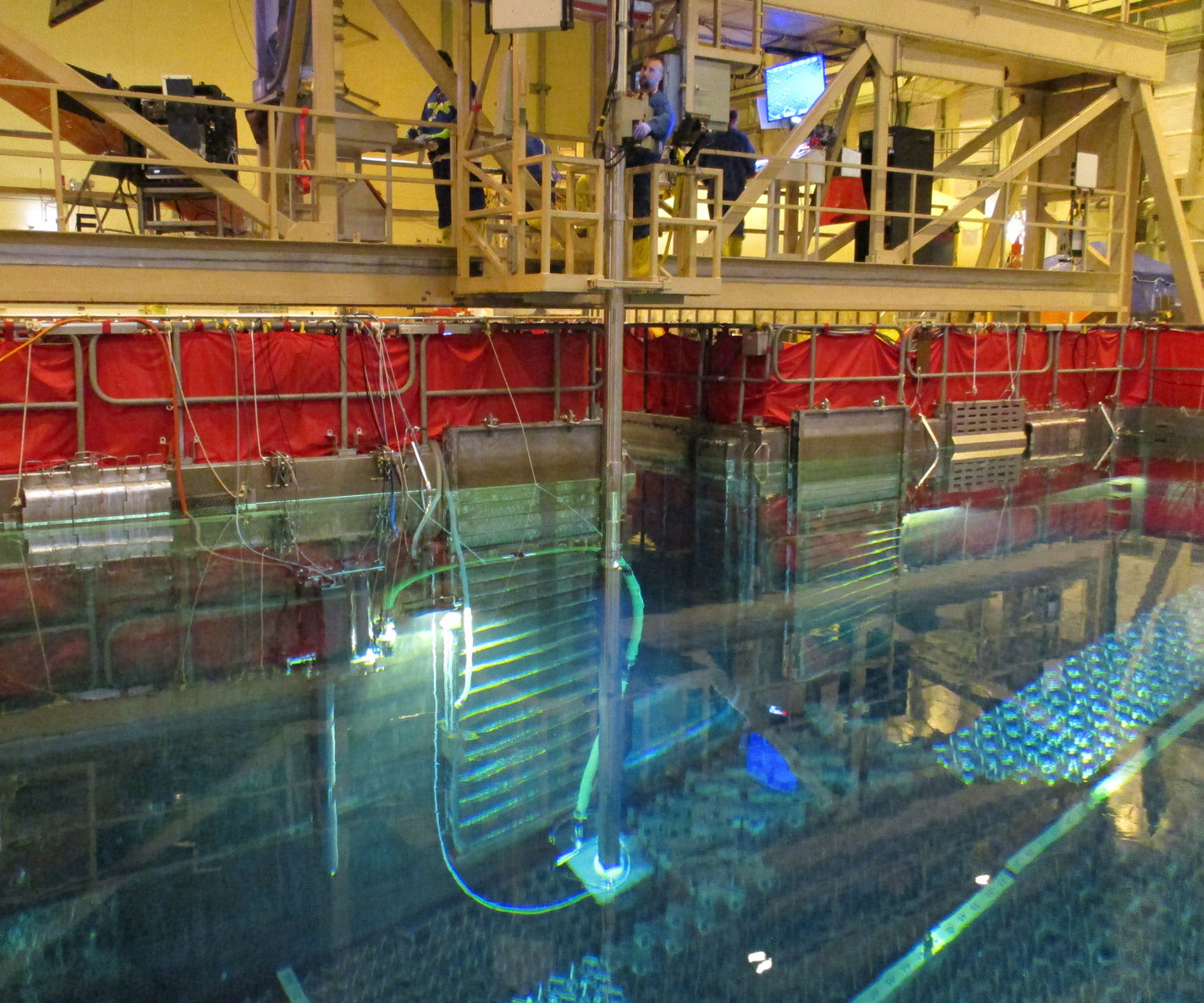

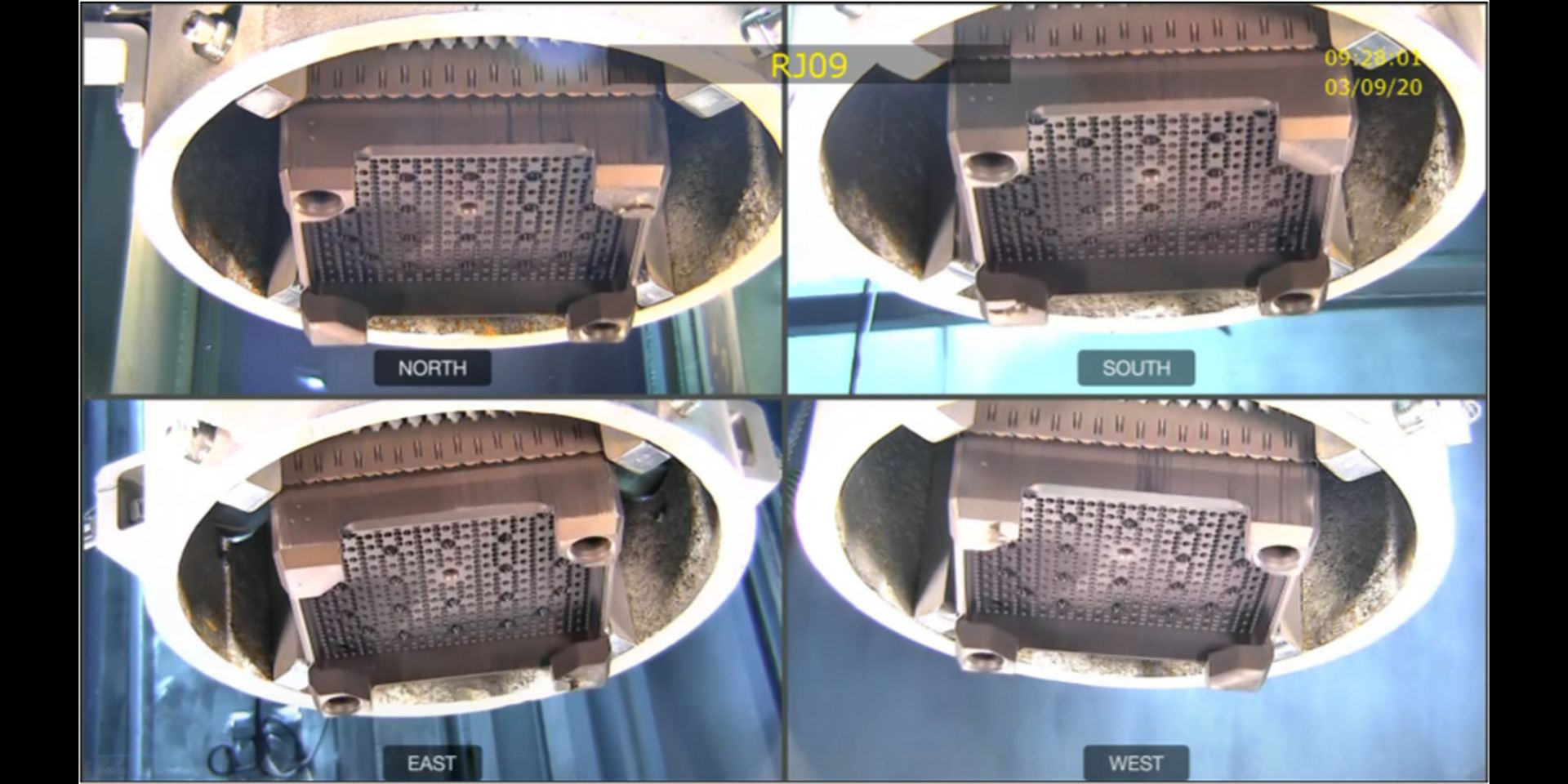

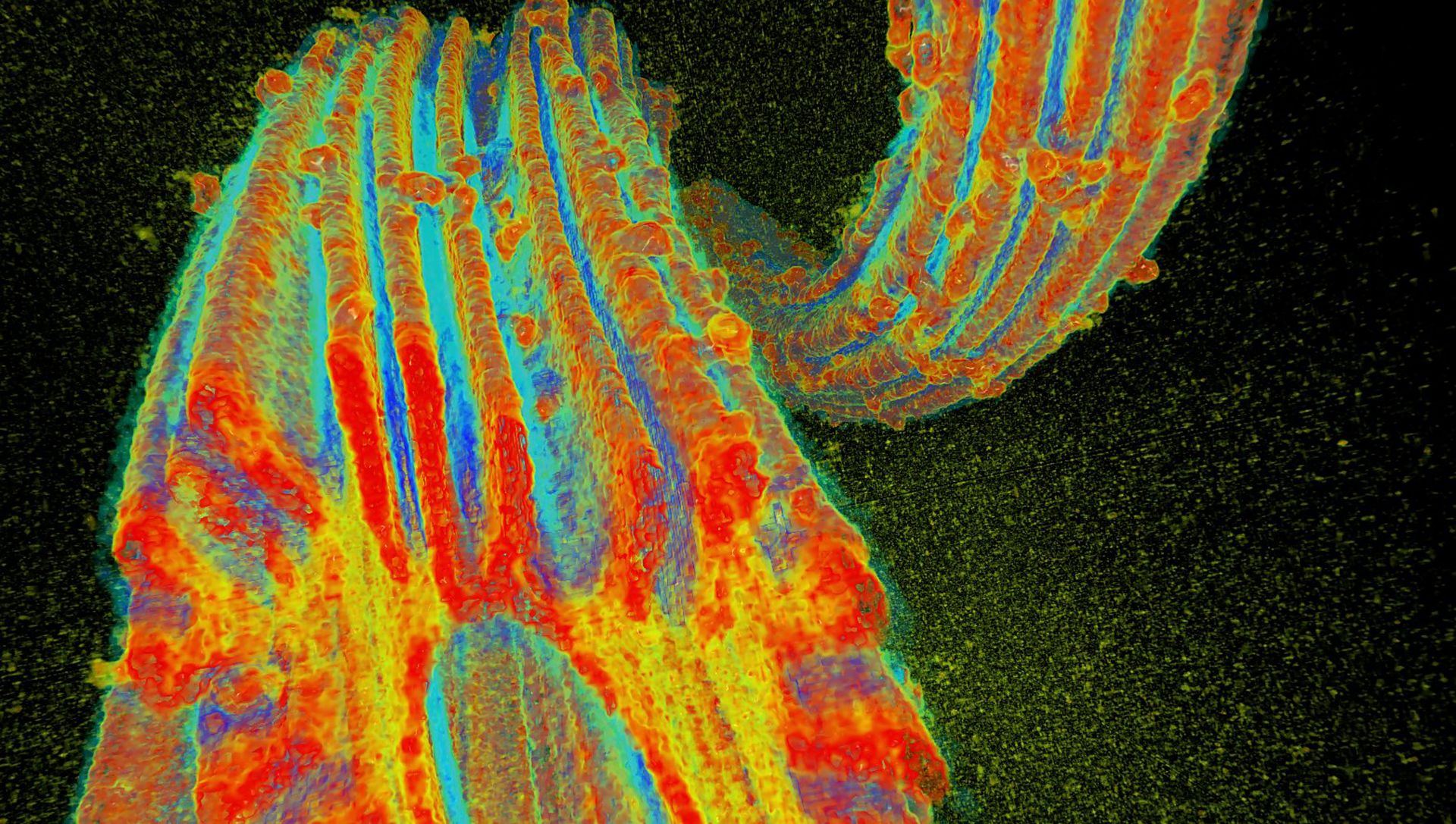

Researchers have been working frantically to develop an array of materials and fibers to economically extract uranium from seawater—and they have succeeded. PNNL scientists exposed this special uranium-sorbing fiber developed at ORNL to Pseudomonas fluorescens and used the Advanced Photon Source at Argonne National Laboratory to create a 3-D X-ray microtomograph to determine microstructure and the effects of interactions with organisms and seawater. (Image: PNNL)

America, Japan, and China are racing to be the first nation to make nuclear energy completely renewable. The hurdle is making it economical to extract uranium from seawater, because the amount of uranium in seawater is truly inexhaustible.

While America had been in the lead with technological breakthroughs from the Department of Energy’s Pacific Northwest and Oak Ridge National Laboratories, researchers at Northeast Normal University in China have sprung ahead. But these breakthroughs from both countries have brought the removal of uranium from seawater within economic reach. The only question is when will the source of uranium for our nuclear power plants change from mined ore to seawater extraction?

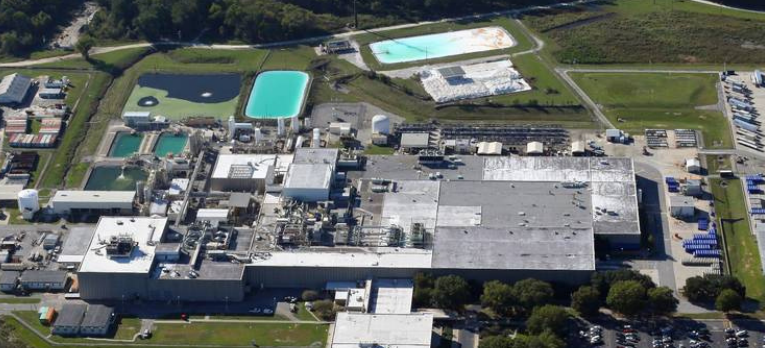

The Westinghouse fuel fabrication facility in South Carolina. (Photo: Westinghouse)

Hundreds of employees at the Westinghouse nuclear fuel fabrication facility in South Carolina are trying to form a union and join the International Brotherhood of Electrical Workers.

Argonne scientists adjust the AMIS beamline prior to its commissioning. (Photo: Argonne)

Argonne’s newest beamline uses heavy ions to degrade a material’s properties as much in a day as a nuclear reactor does in a year, without introducing radioactivity. That’s according to an article published January 16 by Argonne National Laboratory. The Argonne Tandem Linac Accelerator System (ATLAS) now boasts a new beamline—the ATLAS Material Irradiation Station, or AMIS—that uses the accelerator’s lowest high-energy beams to displace atoms and mimic the degradation of materials inside an operating reactor over time. AMIS makes it easier and faster to test candidate fuel and structural materials for existing and future reactors.

Various officials (back row) look on at the fuel supply contract signing in Sofia, Bulgaria. Front row, from left: Angie Darkey, Uranium Asset Management’s managing director; Boris Schucht, Urenco CEO; Tim Gitzel, Cameco president and CEO; and Aziz Dag, Westinghouse senior vice president of global BWR & VVER fuel business.

Canada’s Cameco and U.K.-based Urenco last week jointly announced the signing of agreements to become part of a Westinghouse-led fuel supply chain for Bulgaria’s Kozloduy nuclear power plant. (Also included in the partnership is Uranium Asset Management.)

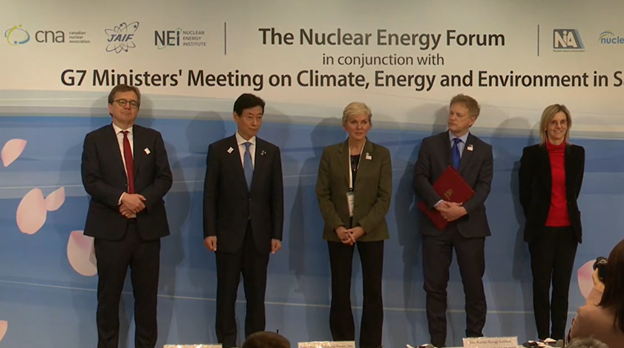

The ministers representing their respective nations as the statement on civil nuclear fuel cooperation was announced were (from left) Jonathan Wilkinson, minister of natural resources of Canada; Yasutoshi Nishimura, Japan’s minister of economy, trade, and industry; Jennifer Granholm, U.S. energy secretary; Grant Shapps, U.K. energy security secretary; and Agnes Pannier-Runacher, French minister for energy transition.

A civil nuclear fuel security agreement between the five nuclear leaders of the G7—announced on April 16 on the sidelines of the G7 Ministers’ Meeting on Climate, Energy and Environment in Sapporo, Japan—establishes cooperation between Canada, France, Japan, the United Kingdom, and the United States to flatten Russia’s influence in the global nuclear fuel supply chain.

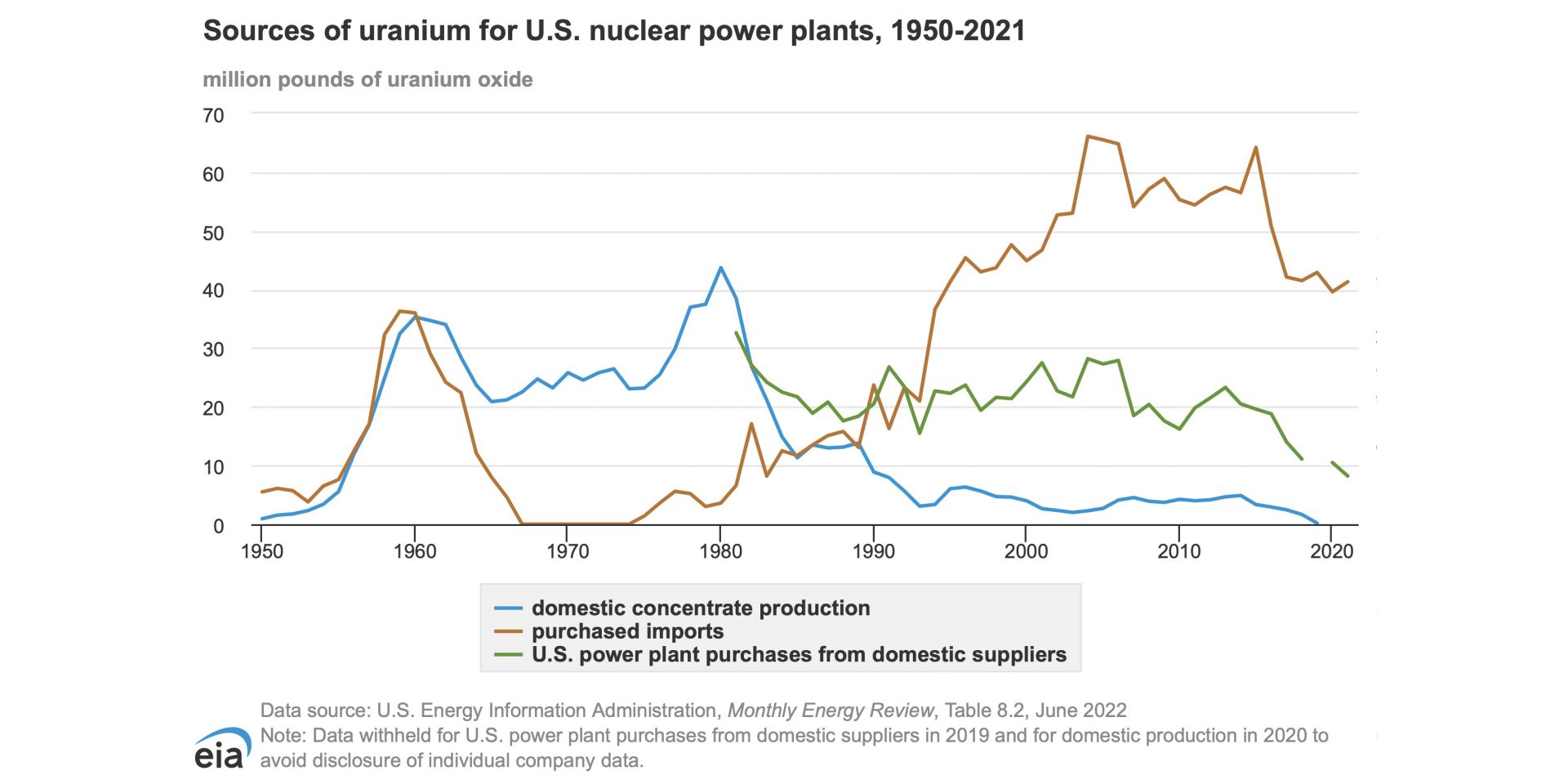

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

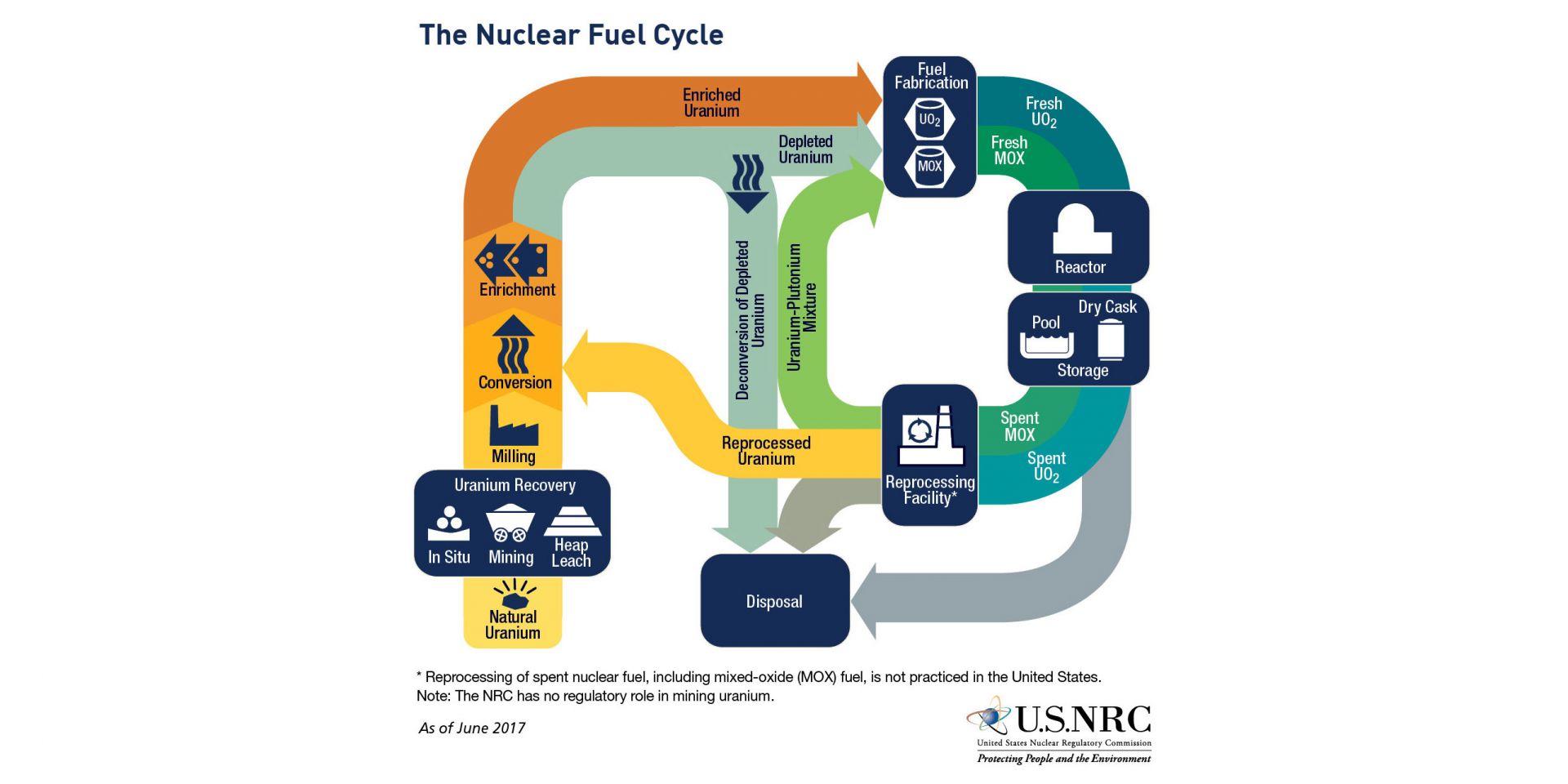

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

According to the World Nuclear Association’s newly released

According to the World Nuclear Association’s newly released